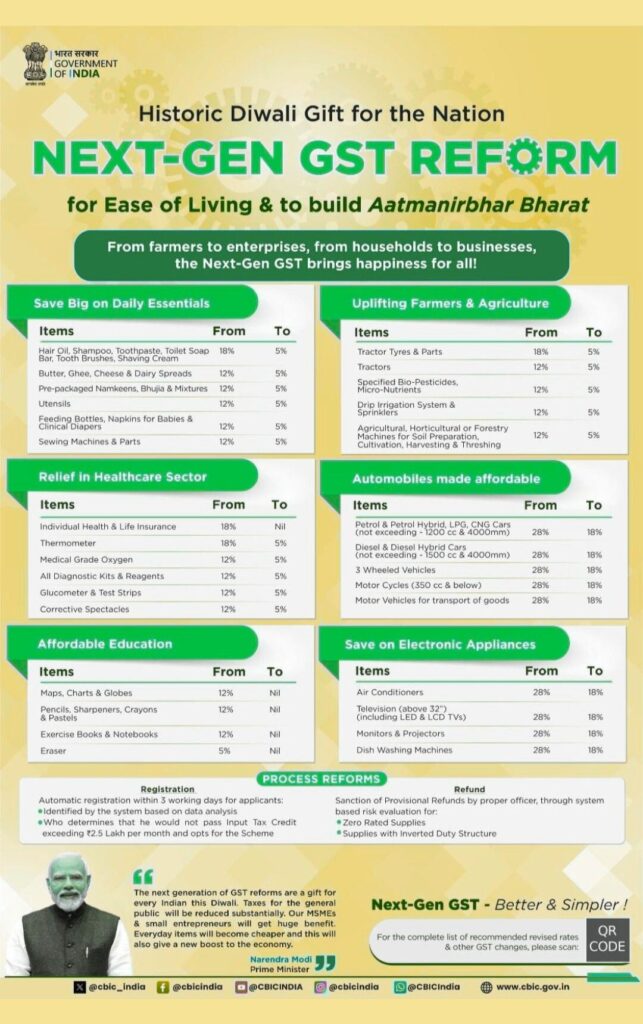

New Delhi: New GST Rate – If you are planning to buy a new car or bike, then there is a great news for you. In the recent meeting of GST Council, historical GST reforms have been made for the automobile sector, which will directly benefit the common consumer. The government has reduced the GST rate on small vehicles, 350 cc bikes and GST rate on three -wheelers from 28%. This change will be applicable from September 22, 2025, which will provide great relief to customers in the coming festive season.

The decision is part of the Next Gen GST Reforms, which aims to simplify the tax system and make things more economical for the general public. The GST Council meeting chaired by Finance Minister Nirmala Sitharaman took several important decisions, including changes in GST rates on health insurance, FMCG stocks and other products.

Small vehicles get a big tax break

Under this new GST slab, the government has tried to make small cars, commuter bikes and auto-rickshaws more accessible. According to the new definition, small cars are petrol cars whose engine capacity is up to 1200cc or diesel cars with a capacity of 1500cc and whose length is less than 4000mm. These include popular cars like Maruti Dzire, Kia Siros.

Vehicles coming in 18% GST slab:

- Small cars: petrol engine up to 1200cc, diesel engine up to 1500cc, and length less than 4000mm.

- Motorcycles up to 350cc: such as Royal Enfield Bullet and Classic 350.

- Three vehicles: auto-rickshaws and other three-wheelers.

- Hybrid cars: Petrol/LPG/CNG up to 1200cc or diesel up to 1500cc, which is less than 4000mm in length.

Luxury and big vehicles also become cheap?

The GST Council has also introduced a new 40% slab, which is placed for luxury and “SIN items”. However, this may take more to hear, but it has a major advantage. Earlier, these vehicles used to levy 22% cess with 28% GST, causing the total tax to reach 50% effectively. The GST reforms have completely removed the cess and these cars will now be taxed at the rate of 40%. This means that large and mid-size SUVs like Hyundai Creta, Kia Celtose, Tata Harrier and Mahindra XUV700 will also be cheaper than before.

Vehicles and goods coming in 40% slab:

- Motorcycles above 350cc: such as KTM Duke 390, Triumph Speed 400.

- Large and mid-size cars: Petrol above 1200cc or diesel above 1500cc, whose length is more than 4000mm.

- Hybrid vehicle: such as Maruti Grand Vitara, Maruti Victoris Honda City

- Aircraft, boats and other entertainment vehicles.

- Cigarettes and other tobacco products.

Relief on commercial vehicles and parts

The GST Council has also simplified the tax structure of commercial vehicles and auto parts. Now bus, trucks and ambulances will be equally 18% GST (first 28%). In addition, all auto parts will now apply the same rate of 18% on all auto parts regardless of HSN code. This step will make the supply chain easier for manufacturers and suppliers.

No change on electric vehicles

There has been no change in GST rate on electric vehicles (EVS). Electric two-wheelers and three-wheelers will continue to have a discounted rate of 5%, making these the most tax-friendly dynamics options. However, there is no clarity for luxury EV whether the same rate will apply to them.

What is special for the general public?

This GST rate cut is a major savings. A cut from 28% to 18% means that customers can save up to Rs 60,000 directly on a small hatchback car with an X-factory price of Rs 6 lakh. It is also a large booster for the automobile sector, as it is expected to increase demand. According to GST News Today, this new GST rate list will give new pace to the country’s economy.

GST status on health insurance

The GST Council has given great relief in GST on personal health and life insurance policies. Now there will be no GST on them, which was 18% earlier. This decision will make healthcare more economical for the common people.

How long will the new rates be implemented?

All GST rate changes will be applicable from September 22, 2025. This means that if you are planning to buy a new vehicle, waiting for the new GST rules can prove beneficial for you. This step will reduce the burden on our pockets and make our festive season even more pleasant.

Read more about New Maruti Car – Maruti Victoris

Pingback: Tata Vehicles Cheaper | Change in GST Rates | New Price Implemented - SamGuestPost